The following article is more than 10 years old but still relevant. It was published in Forbes on 12/4/12, updated on 2/16/13, and written by Danielle and Andy Mayoras, Trials & Heirs, attorneys focusing on celebrity legal issues. Many of you may know that Lincoln famously died without a will. Unexpected since he was an attorney. This article provides information related to how his estate was handled after his death, and how long it took.

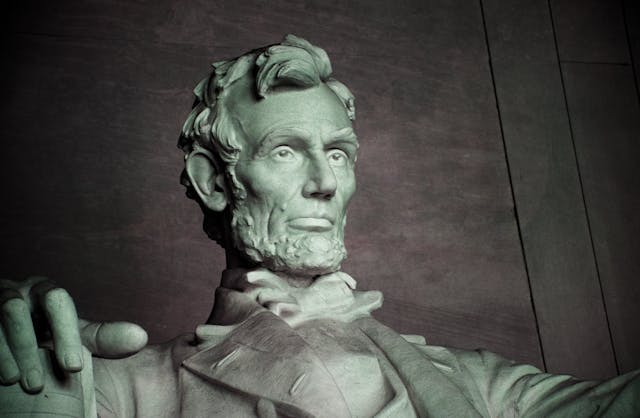

“Abraham Lincoln, the sixteenth President of the United States. (Photo credit: Wikipedia)

Less than four weeks since its release, the movie Lincoln already has earned nearly $84 million at the box office. Chronicling Abraham Lincoln’s historic efforts to abolish slavery, the movie has garnered widespread critical and audience appeal.

At Trial & Heirs, however, we can’t help but think of another aspect of Abraham Lincoln’s life … he is one of the most notable examples of someone dying without a will. This got us thinking, and digging. What did happen to Lincoln’s estate after he died?

According to a series of bulletins issued from the Abraham Lincoln Association, his family was understandably overcome with grief. By noon on the day he died, April 15, 1865, Lincoln’s oldest son, Robert, sent a telegram to Justice David Davis of the United States Supreme Court. Davis was a close friend of Lincoln and Robert considered Davis to be a “second father,” according to a letter Robert wrote years later. The telegram said, “Please come at once to Washington to take charge of my father’s affairs. Answer.”

Davis immediately went to Washington to console Lincoln’s widow, Mary. Mary and Robert together wrote a letter to the Judge of the Sangamon County Court, in Illinois, and asked that he appoint Davis as the administrator of Lincoln’s Estate.

In his initial filing to the court, Davis reported that the estate was believed to be worth $85,000 and would be divided between Mary and Lincoln’s two children alive at the time, Robert and Thomas. That sum would be worth at least a few million dollars in today’s value — although it’s hard to say exactly because the Consumer Price Index which tracks inflation rates only goes back to 1913. Regardless, that was a lot of money to pass without a will.

The Abraham Lincoln Association Bulletins (which you can read here, courtesy of the University of Michigan Library, if you’re curious) have a very detailed recitation of how the Estate was handled. Interestingly, they include a description of a donation that Congress voted to give to Lincoln’s widow, in an amount equal to almost one year of Lincoln’s salary as President, of $25,000. This was paid tax free because it was considered a donation, not salary, and did not pass through Lincoln’s estate.

The estate was eventually settled in November of 1867, with a final sum of $110,296.80 to be divided into three equal shares. Mary could have received an additional cash allowance as the widow, but she declined it.

Justice David Davis did not take any payment for his services or even reimbursement for his expenses. He handled the estate administration on his own, without hiring an attorney, contrary to customary procedure. The Bulletins report that the customary fee permitted by law would have amounted to $6,600.

The Lincoln family was extremely grateful for Justice David Davis’s kindness and help. Indeed, it could have been no easy task for a sitting United States Supreme Court Justice to administer that large of an estate in rural Illinois. The New York Times republished a brief article describing the estate settlement, also noting how Davis, as a warm, personal fried of Lincoln, refused to charge for his services. The article also states that Lincoln’s unpaid debts as of his death totaled only $38.31.

It’s very surprising to many that Abraham Lincoln, an esteemed lawyer in addition to being one of the greatest Presidents in history, never took the time to make out a will, even by age 54. Yet, it’s much more common than most people realize. Some estimates place the number of adult Americans without a will at two-thirds; others place the figure at closer to 55%. Either way, it’s shocking how many people don’t take the time to plan for how their lifetime of savings will pass when they die.

And, just like in Lincoln’s time, the surviving spouse does not inherit everything when someone dies without a will. While laws very from state to state, in most states the estate is split between the children and spouse (depending on how much is in the estate). Many people mistakenly assume if they die, their spouses will automatically inherit everything. That’s simply not the case.

Finally, probate court is no fun for anyone. All probate estates (those with wills and without) are public record. While that helps us write about famous estates, even 150 years later, most people don’t want their personal laundry aired in a public court.

It’s even worse when families fight over the estate. Plus, estates with no wills can be extra complicated and sometimes messier. Not every family has a Supreme Court Justice willing to step in and help.

The good news is that with proper estate planning — including a revocable living trust — probate court can be avoided entirely. Just as Lincoln didn’t plan to pass away that fateful night in April, 1865, neither do most people. So do your loved ones a favor this holiday season and put your estate in order, with the help of a good estate planning attorney.”

Interestingly, Lincoln’s estate, even being managed by a Supreme Court justice, still took more than two years to settle. How much faster and less stressful would it have been for his wife and sons if he had planned ahead? To me, that is the point, as the authors concluded as well; none of us know what today will bring. What will that mean for your loved ones if you don’t have your affairs in order? Will they have to wait more than two years for their inheritance? Let’s get together and put a plan in place to protect them. Call me today at 513-399-7526 or go online to www.davidlefton.com and schedule our meeting there.

Source: Forbes 12/4/12 and updated 2/16/13 and written by Danielle and Andy Mayoras, Trials & Heirs, attorneys who focus on celebrity legal issues.